The cryptocurrency industry, celebrated for its innovation and promise of financial freedom, has faced its share of controversies and setbacks. Among these, the collapse of FTX, a once-prominent cryptocurrency exchange, stands out as one of the most shocking and impactful events in the history of crypto.

The downfall of FTX sent shockwaves through the industry, leaving investors, regulators, and enthusiasts grappling with its consequences. This article delves into the factors that led to the FTX crash, its broader implications, and the lessons it offers to the cryptocurrency ecosystem.

The Rise of FTX

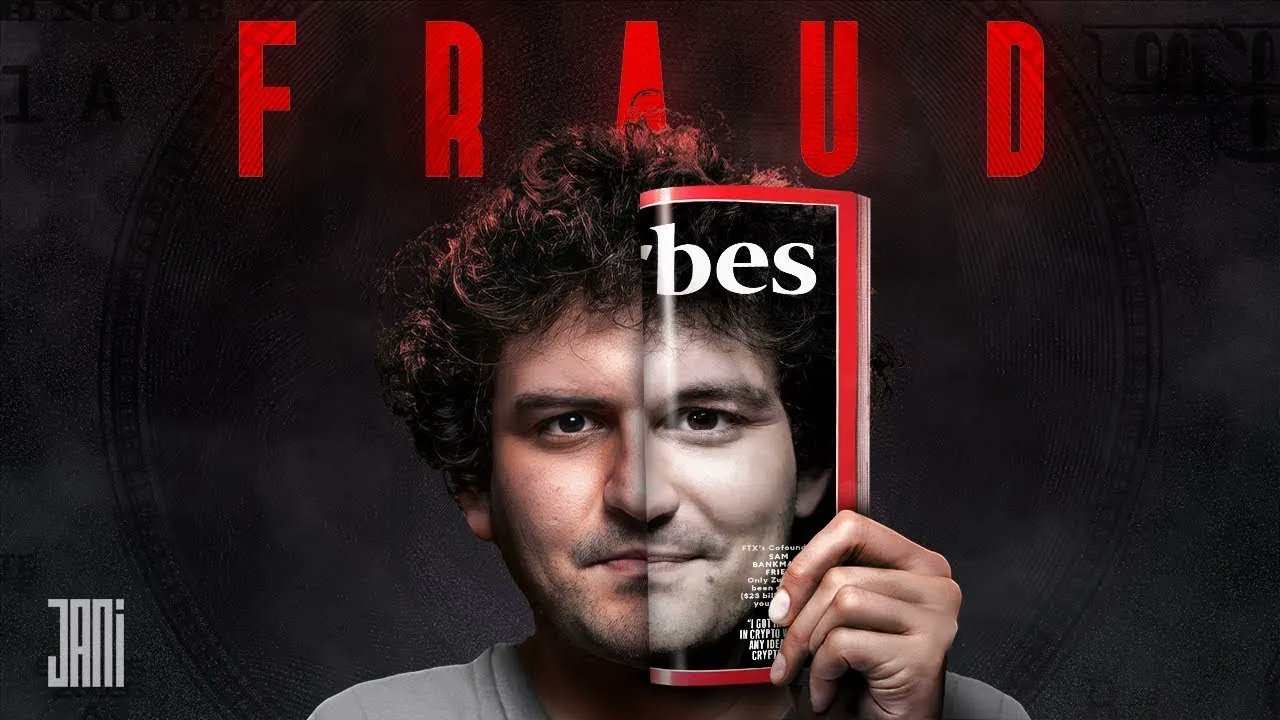

FTX was founded in 2019 by Sam Bankman-Fried (SBF), a former trader and MIT graduate, and quickly rose to prominence as one of the largest cryptocurrency exchanges in the world. FTX differentiated itself through innovative products such as tokenized stocks, leveraged tokens, and a robust derivatives market. With aggressive marketing campaigns, strategic partnerships, and a user-friendly platform, FTX became a trusted name in the cryptocurrency space. By 2021, it had achieved a valuation of $32 billion, attracting high-profile investors, including venture capital firms and celebrities.

The Events Leading to the Crash

The unraveling of FTX began in November 2022, when reports surfaced about the company’s financial instability. The collapse was triggered by the following key factors:

Mismanagement of Funds

At the heart of the FTX collapse was the alleged mismanagement of customer funds. It was revealed that FTX had been funneling customer deposits to its affiliated trading firm, Alameda Research, which was also founded by Bankman-Fried. Alameda used these funds for speculative trading and high-risk investments, leaving a gaping hole in FTX’s balance sheet.

Lack of Transparency

FTX’s internal operations were shrouded in secrecy, with limited accountability or oversight. The lack of transparency created an environment where questionable practices could go unchecked, ultimately eroding trust among investors and users.

Liquidity Crisis

As concerns about FTX’s financial health grew, customers rushed to withdraw their funds, triggering a liquidity crisis. FTX was unable to fulfill withdrawal requests, exposing its insolvency and further exacerbating the situation.

Regulatory and Legal Issues

The exchange operated in a relatively unregulated environment, which allowed it to engage in risky activities without significant repercussions. However, as regulatory scrutiny increased, FTX’s vulnerabilities became more apparent, culminating in investigations and legal actions.

The Fallout

The collapse of FTX had far-reaching consequences, both within and beyond the cryptocurrency industry. Here are some of the key impacts:

Loss of Customer Funds

Millions of FTX users lost access to their funds, with estimates suggesting that over $8 billion in customer assets were unaccounted for. The financial losses devastated individual investors and institutional clients alike.

Market Turmoil

The FTX crash triggered a sharp decline in cryptocurrency prices, wiping out billions of dollars in market value. Bitcoin and other major cryptocurrencies experienced significant sell-offs as panic spread among investors.

Erosion of Trust

The incident dealt a severe blow to the credibility of the cryptocurrency industry. Investors and regulators alike questioned the integrity of exchanges and the broader ecosystem, leading to increased skepticism and caution.

Increased Regulatory Scrutiny

In the aftermath of the collapse, regulators around the world intensified their focus on cryptocurrency exchanges and related entities. The incident underscored the need for stricter oversight, transparency, and consumer protection measures.

Legal Repercussions

Sam Bankman-Fried and other key executives at FTX faced lawsuits and criminal charges, including allegations of fraud and embezzlement. The legal proceedings highlighted the importance of accountability and ethical conduct in the cryptocurrency space.

Lessons from the FTX Crash

The FTX collapse serves as a cautionary tale for the cryptocurrency industry and offers valuable lessons for stakeholders:

The Importance of Transparency

Transparency is crucial for building trust in any financial system. Cryptocurrency exchanges must adopt transparent practices, including regular audits and clear disclosure of their financial health.

Segregation of Funds

Mixing customer funds with operational or investment capital is a recipe for disaster. Exchanges should implement strict policies to ensure the segregation and protection of customer assets.

Stronger Regulatory Frameworks

The lack of regulation in the cryptocurrency industry has allowed bad actors to exploit loopholes and engage in unethical behavior. Clear and enforceable regulations can help create a safer and more reliable ecosystem.

Due Diligence by Investors

Investors should exercise caution and conduct thorough due diligence before entrusting their assets to any platform. Understanding the risks and researching the platform’s track record can help mitigate potential losses.

Accountability and Governance

Strong governance structures and accountability mechanisms are essential for preventing misconduct. Exchanges should prioritize ethical leadership and establish checks and balances to ensure responsible operations.

The Path Forward

While the FTX crash has undoubtedly shaken the cryptocurrency industry, it also presents an opportunity for growth and reform. The lessons learned from this incident can serve as a foundation for building a more resilient and trustworthy ecosystem.

Rebuilding Trust

The industry must work collectively to rebuild trust among investors and users. This includes adopting best practices, fostering transparency, and demonstrating a commitment to ethical behavior.

Innovation with Responsibility

Innovation remains a cornerstone of the cryptocurrency industry, but it must be pursued responsibly. Balancing creativity with risk management is essential for sustainable growth.

Global Collaboration

Regulators, industry leaders, and stakeholders should collaborate to develop a unified approach to oversight and governance. A cohesive framework can help address the unique challenges posed by the global nature of cryptocurrencies.

Education and Awareness

Educating users about the risks and benefits of cryptocurrencies is critical for informed decision-making. Enhanced awareness can empower investors to navigate the complex landscape more effectively.

Final Thoughts

The collapse of FTX is a stark reminder of the vulnerabilities and risks inherent in the cryptocurrency industry. However, it also highlights the potential for growth and improvement. By addressing the underlying issues and embracing transparency, accountability, and regulation, the industry can emerge stronger and more resilient.

As the dust settles, the lessons from the FTX crash will undoubtedly shape the future of cryptocurrency, guiding it toward a more secure and sustainable path. Stakeholders must seize this moment to enact meaningful change and ensure that such a catastrophic event is never repeated.

If you would like to learn more about the FTX crash the below documentary has some great information, it’s called: The Fake Genius: A $30 Billion dollar fraud. It covers much more of what happened before, during and after the FTX crash and is one of the best documentaries on the subject.